First-Time Home Buying in Gurgaon: What You Need to Know Before Signing

Why Gurgaon is a Great Place for First-Time Home Buyers

Gurgaon, also known as Gurugram, has become one of India’s most sought-after destinations for property buyers. With its growing infrastructure, corporate hubs like Cyber City and Golf Course Road, and new-age residential projects, first-time home buyers are flocking to this NCR gem.

But buying your first home is more than just love at first site visit. Here’s everything you need to know before signing that dotted line.

1. Define Your Budget (and Stick to It)

Many first-time buyers overlook hidden charges such as:

- GST on under-construction properties

- Stamp duty & registration fees (typically 5–7%)

- Maintenance deposits, club charges, parking, etc.

Pro Tip: Use a home loan eligibility calculator and consult your bank before setting your budget.

2. Choose the Right Location in Gurgaon

Not all areas in Gurgaon are ideal for first-time buyers. Here’s a quick breakdown:

| Area | Ideal For | Price (2025 est.) |

|---|---|---|

| New Gurgaon (Sectors 81–95) | Budget homes, future growth | ₹6,000–₹8,000/sq.ft |

| Dwarka Expressway | Long-term investment, upcoming infra | ₹7,500–₹10,000/sq.ft |

| Sohna Road | Mid-segment, good connectivity | ₹7,000–₹9,000/sq.ft |

| Golf Course Extension | Premium buyers | ₹12,000–₹20,000/sq.ft |

✅ Tip: Prioritize connectivity (metro, roads), schools, hospitals, and work proximity.

3. Check RERA Registration & Builder Reputation

Before you commit to any property:

- Verify RERA registration on HARERA website

- Check online reviews, construction delays, and builder history

- Visit past projects if possible

Why It Matters: RERA protects you from project delays, poor construction, and legal disputes.

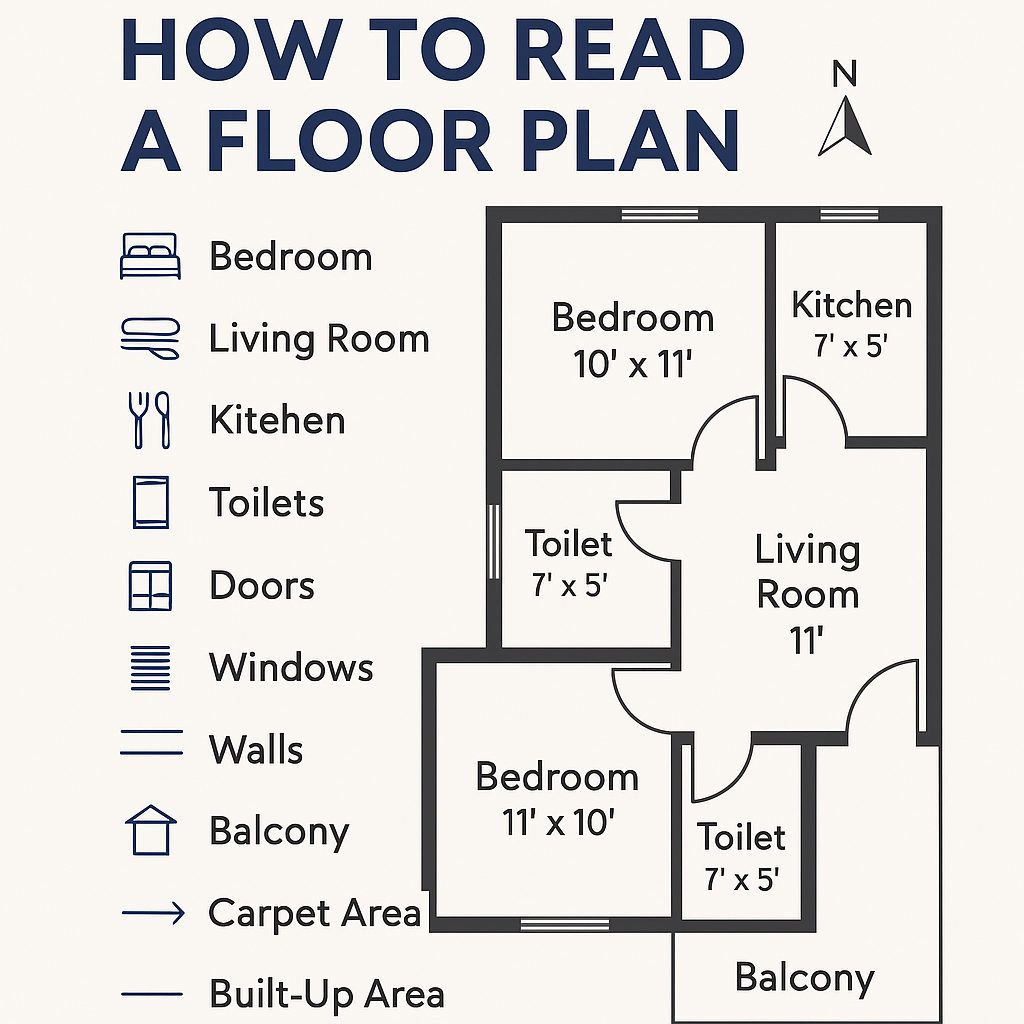

4. Understand the Agreement & Documents

Key documents you must review:

- Builder-Buyer Agreement

- Property title deed & land ownership papers

- Approved building plan

- Occupancy certificate (for ready-to-move)

- No Dues Certificate (NDC) in resale cases

Legal Tip: Always consult a real estate lawyer, especially when buying resale or under-construction property.

5. Loan Pre-Approval Can Save You Time & Stress

- Compare interest rates (SBI, HDFC, ICICI, Axis)

- Get loan pre-approval to increase negotiation power

- Check for PMAY or affordable housing benefits (if eligible)

Common Mistakes First-Time Buyers in Gurgaon Make

- Not visiting the site personally

- Rushing into “pre-launch offers” without RERA number

- Ignoring resale potential

- Falling for luxury features over location

- Not factoring in monthly maintenance costs

Ready-to-Move vs. Under-Construction: What’s Best?

| Factor | Ready-to-Move | Under-Construction |

|---|---|---|

| Possession | Immediate | 2–4 years avg. |

| GST | Not applicable | 5% on value |

| Risk | Lower | Higher |

| Cost | Slightly higher | Can be cheaper |

Verdict: If you’re risk-averse and need quick possession, go for ready-to-move. If you can wait and want appreciation, explore new launches.

Final Checklist Before Signing

✅ Visit the site multiple times

✅ Cross-check RERA and builder credentials

✅ Verify land title & approvals

✅ Get legal help

✅ Confirm loan eligibility and affordability

✅ Think long-term: resale, rental, infrastructure plans

Conclusion

Buying your first home in Gurgaon is exciting, but it’s also a major financial decision. Take your time, do your research, and never sign without understanding what you’re getting into.

👉 Ready to start your property search in Gurgaon?

Comment below or contact us for a free location consultation based on your budget and lifestyle needs!